3x the Rent: Is It Really Ridiculous?

Is it fair to require tenants to earn three times the rent to qualify for an apartment? Many renters find themselves scratching their heads and emptying their pockets to meet this seemingly arbitrary rule. In this insightful blog post, we’ll delve into the controversial 3x rent rule, explore its rationale, and discover clever ways to navigate around it. Whether you’re a landlord, a tenant, or simply curious about the inner workings of the rental market, this article promises to shed light on a topic that affects us all. So, buckle up as we unravel the truth behind the 3x rent hoopla!

Key Takeaways

- Landlords may require 3 times the rent to ensure tenants have enough income to cover living costs and savings.

- Ways around the 3x rent rule include increasing the security deposit, finding a guarantor, or demonstrating financial responsibility with bank statements.

- Some communities recommend an income of at least 2.5 times the monthly rent, rather than 3 times.

- Requiring 3 times the rent can be challenging for tenants, especially in expensive areas, and may be seen as unreasonable by some.

- The 3x rent rule is based on gross income, not net income, and is used to assess a tenant’s ability to afford the rent.

- There is no hard and fast rule that states you need to make three times the rent to get an apartment, and alternative methods can be used to demonstrate financial responsibility.

3x the Rent: Is It Really Ridiculous?

For many renters, the 3x rent rule can seem like an insurmountable barrier. In a competitive housing market, finding an apartment that meets this requirement can be challenging, especially in expensive cities. But where did this rule come from, and is it really necessary?

The Rationale Behind the 3x Rent Rule

Landlords typically use the 3x rent rule to assess a tenant’s ability to afford the rent. The idea is that a tenant who earns three times the monthly rent should have enough income to cover not only the rent but also other living expenses and savings. This rule helps landlords minimize the risk of having tenants who fall behind on rent or damage the property.

Challenges with the 3x Rent Rule

While the 3x rent rule may make sense in theory, it can be challenging for renters to meet in practice. In expensive areas, finding an apartment that rents for less than one-third of one’s income can be nearly impossible. This can make it difficult for low-income renters to find housing, even if they have a good rental history.

Alternatives to the 3x Rent Rule

Fortunately, there are some alternatives to the 3x rent rule that landlords may be willing to consider. These include:

- Increasing the security deposit: Offering a larger security deposit can help landlords feel more confident in a tenant’s ability to pay the rent.

- Finding a guarantor: A guarantor is someone who agrees to co-sign the lease and be responsible for the rent if the tenant defaults.

- Demonstrating financial responsibility: Providing bank statements or other documentation that shows a history of responsible financial management can help landlords see that a tenant is likely to be able to afford the rent.

Conclusion

The 3x rent rule is a common practice among landlords, but it is not always necessary. If you are struggling to find an apartment that meets this requirement, there are other options available. By exploring alternatives and being prepared to negotiate, you can increase your chances of finding an affordable place to live.

Is the 3x Rent Rule Unfair?

The 3x rent rule has been criticized by some as being unfair to tenants. Critics argue that it discriminates against low-income renters and makes it difficult for them to find affordable housing. They also point out that the rule is not based on any empirical evidence that tenants who earn less than three times the rent are more likely to default on their rent.

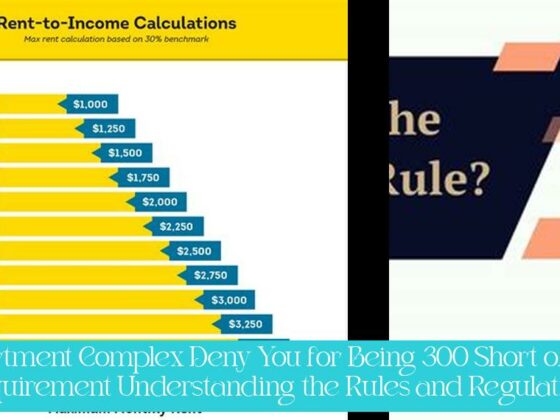

Plus : Mastering the 3x Rent Income Calculator: A Complete Guide for Affordability

Arguments in Favor of the 3x Rent Rule

Despite the criticism, there are some arguments in favor of the 3x rent rule. Landlords argue that it helps them to protect their investment by ensuring that tenants can afford the rent. They also argue that it helps to keep rents affordable by preventing landlords from having to raise rents to cover the cost of bad debts.

A Balanced Approach

Ultimately, whether or not the 3x rent rule is fair is a matter of opinion. There are valid arguments on both sides of the issue. However, it is important to remember that the rule is not set in stone. Landlords are free to make exceptions, and tenants should not be afraid to negotiate.

3x Rent Rule: Understanding Gross vs. Net Income and How to Meet Landlords’ Requirements

Conclusion

The 3x rent rule is a common practice among landlords, but it is not always necessary. If you are struggling to find an apartment that meets this requirement, there are other options available. By exploring alternatives and being prepared to negotiate, you can increase your chances of finding an affordable place to live.

How to Get Around the 3x Rent Rule

If you are struggling to find an apartment that meets the 3x rent rule, there are a few things you can do to get around it.

— Dock Insurance Cost: A Complete Guide to Types, Coverage, and Factors Affecting Insurance Costs

- Talk to your landlord: Be honest with your landlord about your financial situation. Explain that you are willing to pay the rent on time and take good care of the property, even if you do not meet the 3x rent rule.

- Offer a larger security deposit: Offering a larger security deposit can help landlords feel more confident in your ability to pay the rent.

- Find a guarantor: A guarantor is someone who agrees to co-sign the lease and be responsible for the rent if you default.

- Demonstrate financial responsibility: Providing bank statements or other documentation that shows a history of responsible financial management can help landlords see that you are likely to be able to afford the rent.

Conclusion

The 3x rent rule is a common practice among landlords, but it is not always necessary. If you are struggling to find an apartment that meets this requirement, there are other options available. By exploring alternatives and being prepared to negotiate, you can increase your chances of finding an affordable place to live.

1. Is there a way around the 3x rent rule?

Answer: You may still be able to get the apartment by increasing the security deposit, finding a guarantor, or demonstrating your financial responsibility even if you don’t make three times the rent by providing your potential landlord with bank statements that show financial responsibility and sound decision-making regarding your finances.

2. Why do landlords want you to make 3 times the rent?

Answer: In general, it suggests that your gross monthly income (before taxes and other deductions) should be at least three times the monthly rent. This rule helps ensure that you have enough income to cover not just rent, but also other living costs and savings.

3. Is 2.5 times the rent an alternative to the 3x rent rule?

Answer: Some communities recommend an income of at least 2.5 times the monthly rent, rather than 3 times. This can be seen as a more reasonable requirement for tenants, especially in expensive areas.

4. What are some alternatives to the 3x rent rule?

Answer: Alternatives to the 3x rent rule include increasing the security deposit, finding a guarantor, or demonstrating financial responsibility with bank statements. These options can help landlords feel more confident in a tenant’s ability to pay the rent.

5. Why is the 3x rent rule challenging for tenants?

Answer: Requiring 3 times the rent can be challenging for tenants, especially in expensive areas, and may be seen as unreasonable by some. It can make it difficult for low-income renters to find housing, even if they have a good rental history.

6. What is the rationale behind the 3x rent rule?

Answer: Landlords use the 3x rent rule to assess a tenant’s ability to afford the rent. The idea is that a tenant who earns three times the monthly rent should have enough income to cover not only the rent but also other living expenses and savings. This rule helps landlords minimize the risk of having tenants who fall behind on rent or damage the property.