Unlock the Secret to Landing Your Dream Apartment: The 2.5 Times Rent Rule Demystified! Ever wondered if there’s a magic number that determines whether you qualify for that perfect rental? Look no further! We’re diving into the nitty-gritty of the 2.5 times monthly rent rule, revealing why it matters, when it doesn’t, and how to ace it like a pro. Whether you’re a landlord or a tenant, this game-changing insight is a must-know for anyone navigating the rental jungle. Let’s crack the code together and make renting a breeze!

Key Takeaways

Discover: Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

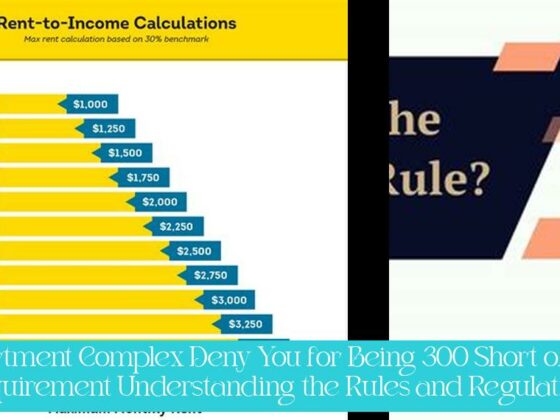

- The 2.5 times the monthly rent rule means that a tenant’s gross income should be at least 2.5 times the monthly rent to qualify as a stable tenant.

- Some communities use a 3 times rent calculator formula, but the recommended income is at least 2.5 times the monthly rent amount.

- For example, for a $1,000 per month apartment, the tenant should be earning at least $2,500 per month in gross income.

- Landlords often require tenants to make 2 or even 3 times the amount of rent to get approved for an apartment.

- The 2.5 times rent rule is a common standard to ensure that tenants do not spend too much of their income on rent.

- When considering a tenant’s gross monthly income, it should be at least 2.5 times their monthly rent according to the rule.

Understanding the 2.5 Times Monthly Rent Rule

In the realm of apartment hunting, potential tenants often encounter the “2.5 times the monthly rent” rule. This financial guideline serves as a common benchmark for landlords to assess a tenant’s ability to afford rent payments and maintain financial stability. The rule dictates that a tenant’s gross monthly income should be at least 2.5 times the monthly rent amount. For instance, if an apartment rents for $1,000 per month, the tenant should ideally earn at least $2,500 per month in gross income.

More updates: Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

The 2.5 times rent rule is widely used as a standard for evaluating a tenant’s financial capacity. It aims to ensure that tenants do not allocate an excessive portion of their income towards rent payments, which could lead to financial strain or difficulty meeting other essential expenses. By adhering to this rule, landlords can mitigate the risk of tenants defaulting on rent or facing financial hardship.

Rationale Behind the 2.5 Times Rent Rule

The 2.5 times rent rule is rooted in several sound financial principles. Firstly, it aligns with the recommended debt-to-income ratio (DTI) guidelines. The DTI ratio measures the percentage of a person’s monthly income allocated towards debt payments, including rent. Financial experts generally advise that individuals maintain a DTI ratio below 36%, indicating that no more than 36% of their gross income should be spent on debt payments. By adhering to the 2.5 times rent rule, landlords can ensure that tenants have sufficient disposable income to cover other essential expenses and avoid excessive financial burdens.

Secondly, the 2.5 times rent rule helps landlords assess a tenant’s financial stability and reliability. Tenants who meet or exceed this income requirement demonstrate a higher likelihood of being able to consistently make rent payments on time and in full. This financial stability reduces the risk of rental income loss for landlords and contributes to the overall financial health of the property.

Exceptions and Variations to the 2.5 Times Rent Rule

While the 2.5 times rent rule is a widely accepted standard, there may be instances where exceptions or variations apply. Certain factors, such as the local rental market, economic conditions, and the specific property, can influence the landlord’s decision-making process.

In highly competitive rental markets, where demand for housing exceeds supply, landlords may be more flexible with the 2.5 times rent rule. They may consider tenants with slightly lower incomes if they have a strong rental history, a stable job, or other mitigating factors. Conversely, in less competitive rental markets, landlords may be more stringent in applying the 2.5 times rent rule, particularly for higher-priced properties.

Additional Considerations for Landlords

Beyond the 2.5 times rent rule, landlords may consider other factors when evaluating a tenant’s financial stability. These factors can include:

-

Proof of income: Landlords typically request pay stubs, bank statements, or other documentation to verify a tenant’s income. This documentation provides tangible evidence of the tenant’s financial capacity.

-

Rental history: A positive rental history, with on-time rent payments and no evictions, is a strong indicator of a tenant’s reliability and financial responsibility. Landlords may request references from previous landlords to assess a tenant’s rental history.

-

Credit score: A credit score provides insights into a tenant’s overall financial management. A high credit score indicates a history of responsible credit use and a lower risk of defaulting on rent payments.

-

Debt-to-income ratio: As mentioned earlier, landlords may consider a tenant’s debt-to-income ratio to assess their overall financial health. A high DTI ratio, indicating a significant portion of income allocated towards debt payments, may raise concerns about a tenant’s ability to afford rent.

By considering these additional factors in conjunction with the 2.5 times rent rule, landlords can make more informed decisions about tenant selection and minimize the risk of financial loss or tenant turnover.

1. What is the 2.5 times the monthly rent rule?

The 2.5 times the monthly rent rule is a financial guideline used by landlords to assess a tenant’s ability to afford rent payments. It dictates that a tenant’s gross monthly income should be at least 2.5 times the monthly rent amount.

2. Why is the 2.5 times rent rule important?

The rule is important because it ensures that tenants do not allocate an excessive portion of their income towards rent payments, which could lead to financial strain or difficulty meeting other essential expenses. It also helps landlords mitigate the risk of tenants defaulting on rent or facing financial hardship.

3. What is the rationale behind the 2.5 times rent rule?

The 2.5 times rent rule aligns with recommended debt-to-income ratio (DTI) guidelines, ensuring tenants have sufficient disposable income to cover other essential expenses and avoid excessive financial burdens. It also helps landlords assess a tenant’s financial stability and reliability.

4. Is 2.5 times rent enough?

Yes, the 2.5 times rent rule is widely used as a standard for evaluating a tenant’s financial capacity. It aims to ensure that tenants have the financial stability to consistently make rent payments on time and in full.

5. How is the 2.5 times rent calculated?

To calculate the 2.5 times rent, you simply multiply the monthly rent amount by 2.5. For example, if the monthly rent is $1,000, the tenant should ideally earn at least $2,500 per month in gross income.

6. What does the 2.5 times rent rule mean for tenants?

For tenants, the 2.5 times rent rule means that their gross monthly income should be at least 2.5 times the monthly rent amount to qualify as a stable tenant. This ensures they have the financial capacity to meet their rent obligations and maintain financial stability.