Are you ready to decode the mystery of “2.5 Times Rent: Gross or Net?” Whether you’re a tenant aiming to impress your landlord or a landlord looking to set fair rental criteria, understanding the 2.5x rent rule is crucial. Join us as we unravel the complexities of calculating 2.5 times rent, explore the nuances of gross vs. net income, and uncover the exceptions to this golden rule. Let’s dive in and demystify the world of rental affordability!

Key Takeaways

- The 2.5x rent rule means that a tenant should be earning at least 2.5 times the monthly rent in gross income.

- Landlords typically use the 2.5x rent multiplier to ensure tenants have enough income to afford the rent.

- When determining affordability, the 2.5x rent rule is based on gross income, not net income.

- For example, if the monthly rent is $1,000, the tenant should have a gross income of at least $2,500 per month to meet the 2.5x rent requirement.

- The 2.5x rent rule is a common guideline used by landlords to assess a tenant’s financial capability to afford the rent.

- It’s important for tenants to understand whether landlords require gross or net income when applying the 2.5x rent rule for rental approval.

2.5 Times Rent: Gross or Net?

When searching for an apartment, you’ll likely encounter the term “2.5 times rent.” This is a common guideline used by landlords to assess a tenant’s financial capability to afford the rent. But what exactly does it mean? And is it based on gross or net income?

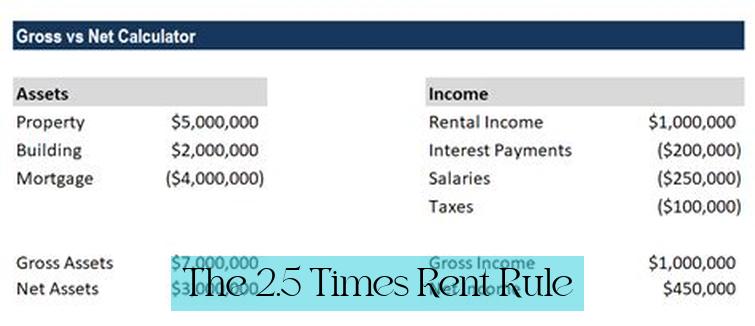

Gross Income vs. Net Income

Gross income is your total income before taxes and other deductions. Net income is your income after taxes and other deductions have been taken out. So, if you earn $50,000 per year, your gross income is $50,000. However, if you pay $10,000 in taxes and other deductions, your net income is $40,000.

The 2.5 Times Rent Rule

The 2.5 times rent rule means that a tenant should be earning at least 2.5 times the monthly rent in gross income. For example, if the monthly rent is $1,000, the tenant should have a gross income of at least $2,500 per month to meet the 2.5 times rent requirement.

For you, Unlocking the 3x Rent Rule: Calculating Affordable Rent and Exceptions

This rule is based on the assumption that housing costs should not exceed 30% of a person’s gross income. So, if the monthly rent is $1,000, the tenant should have a gross income of at least $3,333 per month to meet the 30% rule.

Gross or Net Income?

When determining affordability, the 2.5 times rent rule is typically based on gross income, not net income. This is because gross income provides a more accurate picture of a person’s ability to pay rent. Net income can vary significantly depending on a person’s tax situation and other deductions.

For example, a person with a high income but a lot of deductions may have a low net income. However, they may still be able to afford a higher rent payment because their gross income is high.

Reading List: Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

Exceptions to the Rule

There may be some exceptions to the 2.5 times rent rule. For example, a landlord may be willing to rent to a tenant who does not meet the 2.5 times rent requirement if they have a good rental history or other factors that make them a desirable tenant.

Additionally, some landlords may be willing to accept a lower rent payment if the tenant is willing to sign a longer lease or make a larger security deposit.

Read Also : The Ultimate Guide to the 2.5 Times Monthly Rent Rule in NYC: Everything You Need to Know

Calculating 2.5 Times Rent

To calculate 2.5 times rent, simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, 2.5 times rent would be $2,500.

Also read Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

Here is a table that shows the 2.5 times rent requirement for different monthly rent amounts:

| Monthly Rent | 2.5 Times Rent |

|—|—|

| $1,000 | $2,500 |

| $1,200 | $3,000 |

| $1,500 | $3,750 |

| $2,000 | $5,000 |

| $2,500 | $6,250 |

Conclusion

The 2.5 times rent rule is a common guideline used by landlords to assess a tenant’s financial capability to afford the rent. It is typically based on gross income, not net income. However, there may be some exceptions to the rule, and landlords may be willing to rent to tenants who do not meet the 2.5 times rent requirement if they have other factors that make them desirable tenants.

1. What does it mean to make 2.5 times the rent?

The guideline of making 2.5 times the rent means that a tenant should be earning at least 2.5 times the monthly rent in gross income to meet the financial capability assessment for renting an apartment.

2. Should rent be based on gross or net income?

When applying the 2.5 times rent rule, it is typically based on gross income rather than net income. This is because gross income provides a more accurate picture of a person’s ability to pay rent.

3. Why is the 2.5 times rent rule based on gross income?

The 2.5 times rent rule is based on gross income because it provides a more consistent and reliable measure of a person’s financial capability, unaffected by individual tax situations and deductions.

4. Are there exceptions to the 2.5 times rent rule?

Yes, there may be exceptions to the 2.5 times rent rule. Landlords may consider factors such as a good rental history or other desirable tenant qualities when assessing a tenant’s financial capability.

5. How do I calculate 2.5 times the rent?

To calculate 2.5 times the rent, simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month in gross income to meet the 2.5 times rent requirement.

6. What is the purpose of the 2.5 times rent rule?

The 2.5 times rent rule is used by landlords to ensure that tenants have enough income to afford the rent, based on the assumption that housing costs should not exceed 30% of a person’s gross income.