Welcome to our comprehensive guide on the 3x rent income calculator for Missouri residents! If you’ve ever wondered if you meet the 3x rent rule or how to calculate it, you’ve come to the right place. Whether you’re a seasoned renter or just starting out on your apartment-hunting journey, understanding the 3x rent rule is crucial. In this guide, we’ll break down the ins and outs of this rule, provide practical tips for calculating your 3x rent, and explore alternative solutions for those who may not meet the requirement. So, grab your calculator and get ready to dive into the world of rent affordability in Missouri!

Key Takeaways

- To calculate if you make 3 times the rent, simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month.

- If you don’t make three times the rent, you may still be able to get the apartment by increasing the security deposit, finding a guarantor, or demonstrating your financial responsibility.

- According to the 3x rent rule, a person or household should not spend more than 3 times their gross monthly income on rent.

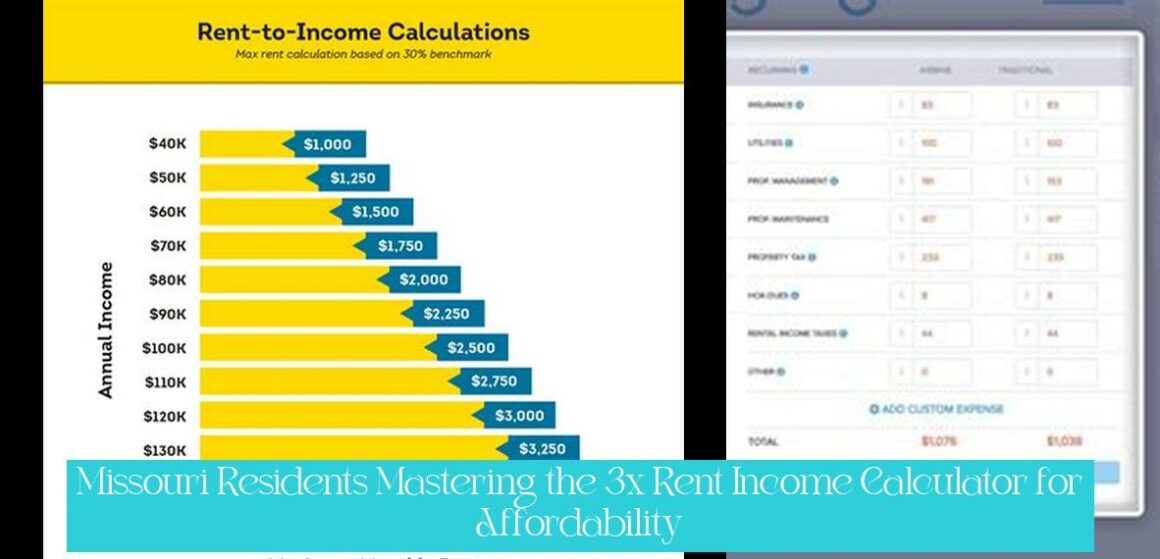

- The 30% rule states that your rent should be no more than 30% of your gross monthly income, and you can use this to determine the maximum rent you can afford.

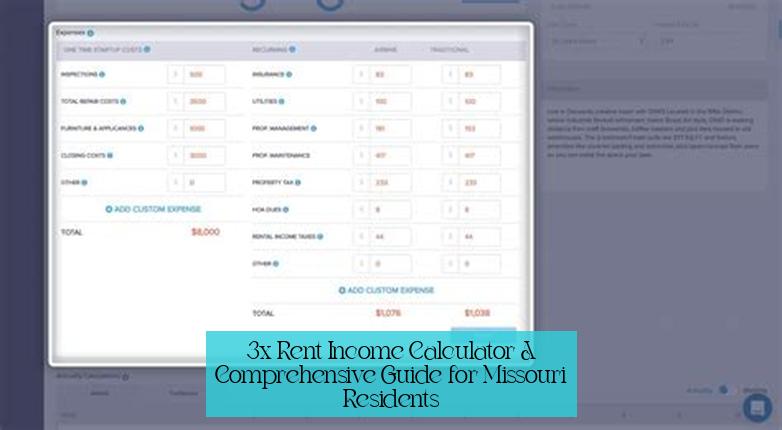

- There are various rent affordability calculators available online that can help you determine how much rent you can afford based on your income and expenses.

- Using a rent calculator can assist in finding the ideal budget for renting an apartment based on your salary.

3x Rent Income Calculator: A Comprehensive Guide for Missouri Residents

— Mastering the 3x Rent Income Calculator: A Complete Guide for Affordability

Understanding the 3x Rent Rule

The 3x rent rule is a widely accepted benchmark used by landlords to assess a potential tenant’s financial capacity to afford rent. According to this rule, an individual or household should not allocate more than three times their gross monthly income towards rent expenses. The rationale behind this rule is to ensure that tenants have sufficient disposable income to cover other essential expenses, such as food, transportation, utilities, and savings.

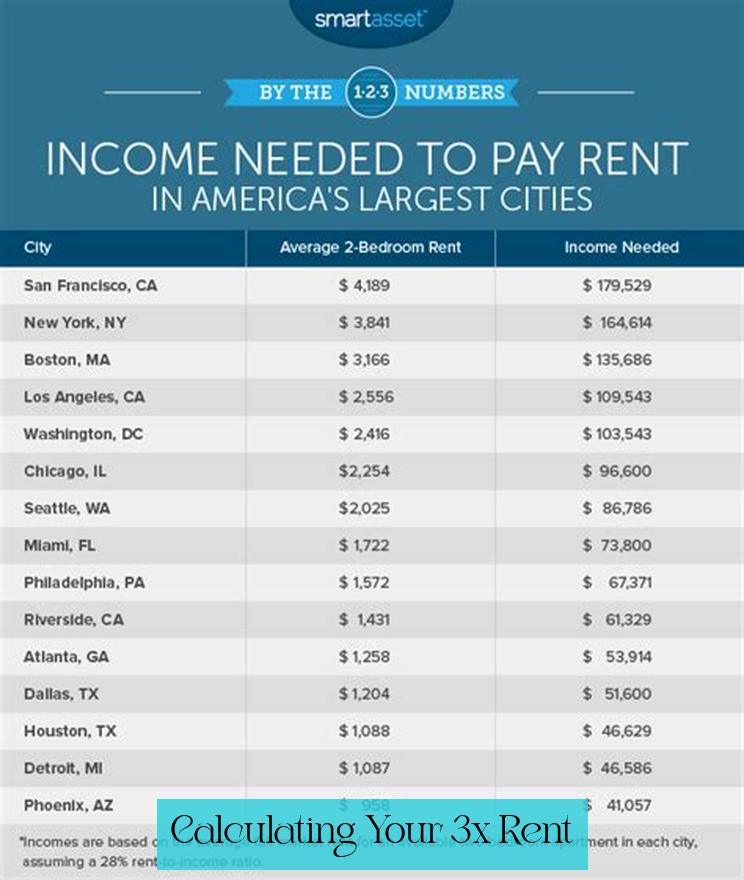

Calculating Your 3x Rent

Calculating your 3x rent is a straightforward process. Simply multiply your monthly rent by 3. For instance, if your monthly rent is $1,000, you would need to earn at least $3,000 per month to meet the 3x rent requirement.

Affordability Considerations

While the 3x rent rule is a useful guideline, it’s important to consider your own financial situation and affordability. Some factors to keep in mind include:

- Income stability: Ensure that your income is consistent and reliable.

- Debt obligations: Factor in your monthly debt payments, such as car loans, student loans, and credit card bills.

- Savings goals: Consider your savings goals and ensure that you can still contribute to them after paying rent.

- Emergency fund: Maintain an emergency fund to cover unexpected expenses.

Alternatives to Meeting the 3x Rent Rule

If you don’t meet the 3x rent requirement, there are several strategies you can explore:

- Increase your security deposit: Offering a larger security deposit can demonstrate your financial responsibility and willingness to commit.

- Find a guarantor: A guarantor is a third party who agrees to cover your rent if you default.

- Provide proof of financial responsibility: Submit bank statements or other documents that show your ability to manage your finances responsibly.

>> State Farm Dock Insurance: Comprehensive Coverage for Your Waterfront Property

Using a Rent Calculator

Numerous online rent calculators can help you determine how much rent you can afford. These calculators typically consider your income, expenses, and financial goals to provide a personalized recommendation.

— 3x Rent Rule: Understanding Gross vs. Net Income and How to Meet Landlords’ Requirements

Additional Tips for Renting in Missouri

- Research the rental market: Familiarize yourself with rental rates in your desired area to avoid overpaying.

- Be prepared with documentation: Gather necessary documents, such as proof of income, references, and a credit report.

- Negotiate with landlords: Don’t hesitate to negotiate rent or other terms of the lease that are within your budget.

- Seek professional advice: If you encounter any challenges in finding affordable housing, consider consulting a housing counselor or financial advisor.

Conclusion

The 3x rent rule is a valuable guideline for assessing your financial readiness to rent an apartment. By carefully considering your income, expenses, and affordability factors, you can make an informed decision about your housing options. Remember, there are alternatives available if you don’t meet the 3x rent requirement. With thorough research, preparation, and negotiation, you can secure a rental property that aligns with your budget and lifestyle.

1. How do you calculate if you make 3 times the rent?

To calculate if you make 3 times the rent, simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month (500 x 3) according to the rule.

2. How do you get around making 3 times the rent?

You may still be able to get the apartment by increasing the security deposit, finding a guarantor, or demonstrating your financial responsibility even if you don’t make three times the rent by providing.

3. What is the 3x rent rule and why is it important?

The 3x rent rule states that a person or household should not spend more than 3 times their gross monthly income on rent. It’s important as it ensures tenants have enough disposable income for other essential expenses.

4. What are some considerations for rent affordability?

Considerations for rent affordability include income stability, debt obligations, savings goals, and maintaining an emergency fund to cover unexpected expenses.

5. What are some alternatives to meeting the 3x rent rule?

Alternatives to meeting the 3x rent rule include increasing your security deposit, finding a guarantor, or providing proof of financial responsibility through bank statements or other documents.

6. How can a rent calculator help in determining rent affordability?

A rent calculator can assist in finding the ideal budget for renting an apartment based on your salary, helping you determine how much rent you can afford based on your income and expenses.