Are you ready to crack the code on affording your dream rental without breaking the bank? Look no further than our comprehensive guide to the 3x Rent Income Calculator! Whether you’re a seasoned renter or a first-time apartment hunter, understanding the 3x rent rule is the key to unlocking the perfect living space within your budget. From demystifying the calculation process to exploring creative solutions for those with lower incomes, we’ve got you covered. So, buckle up and get ready to master the art of budget-friendly renting!

Key Takeaways

- To calculate 3x the rent, simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month (500 x 3).

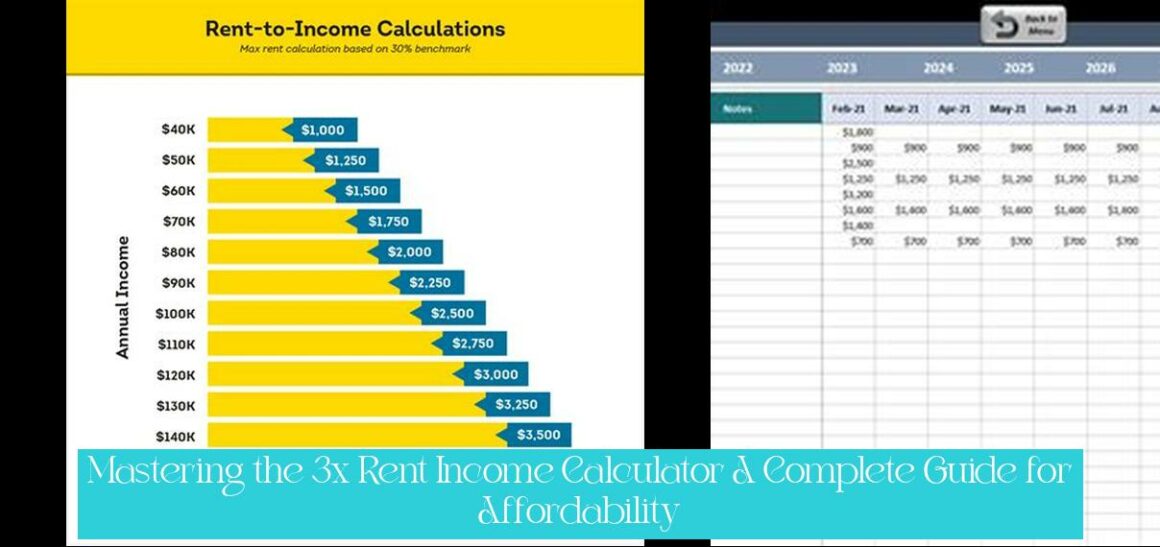

- For an annual salary of $70,000, the monthly rent affordable would be $1,750, according to the 3x rent rule.

- If you don’t make 3 times the rent, you may still be able to get the apartment by increasing the security deposit, finding a guarantor, or demonstrating your financial responsibility.

- Some communities use a 3 times rent calculator formula, meaning a renter’s monthly income should be at least 3 times what goes to paying rent, while others recommend that your income is at least 2.5 times your monthly rent amount.

- The 3x rent rule is based on gross income, not net income, and it’s important to consider your financial situation and responsibilities before committing to a rental amount.

- Use rent calculators to determine how much rent you can afford based on your income, ensuring you stay on budget while searching for a rental property.

3x Rent Income Calculator: A Comprehensive Guide

Understanding the 3x Rent Rule

The 3x rent rule is a widely used guideline that states that a renter’s monthly income should be at least three times the monthly rent amount. This rule is based on the assumption that housing expenses should not exceed 30% of a renter’s gross income. For example, if the monthly rent is $1,500, the renter should earn at least $4,500 per month to qualify for the apartment.

The 3x rent rule is not a legal requirement, but it is often used by landlords and property managers as a screening criterion. Landlords may be hesitant to rent to tenants who do not meet the 3x rent requirement, as they may be concerned about the tenant’s ability to pay the rent on time.

There are some exceptions to the 3x rent rule. For example, some communities use a 2.5x rent rule, while others may allow renters to make up for a lower income by increasing their security deposit or finding a guarantor.

Calculating Your 3x Rent Income

Calculating your 3x rent income is simple. Simply multiply your monthly rent by 3. For example, if your monthly rent is $1,500, your 3x rent income would be $4,500.

You can also use a 3x rent calculator to determine your 3x rent income. These calculators are available online and can be found on websites such as Zillow and Trulia.

Affording Rent on a Lower Income

If you do not make 3x the rent, there are still ways to afford rent. You may be able to increase your security deposit, find a guarantor, or demonstrate your financial responsibility to the landlord.

Increasing your security deposit can make you a more attractive candidate for a rental property. Landlords are more likely to rent to tenants who are willing to put down a larger security deposit, as this reduces their risk of losing money if the tenant damages the property or breaks the lease.

Finding a guarantor can also help you qualify for a rental property. A guarantor is someone who agrees to pay your rent if you are unable to do so. Having a guarantor can give the landlord peace of mind and make them more likely to rent to you, even if you do not meet the 3x rent requirement.

Demonstrating your financial responsibility can also help you qualify for a rental property. You can do this by providing the landlord with bank statements that show that you have a history of paying your bills on time and managing your finances responsibly.

Dock Insurance Cost: A Complete Guide to Types, Coverage, and Factors Affecting Insurance Costs

Populaire en ce moment — Understanding Homeowners Insurance Coverage for Boat Lifts: What You Need to Know

Conclusion

The 3x rent rule is a useful guideline that can help you determine how much rent you can afford. However, it is important to remember that this is just a guideline and there are exceptions to the rule. If you do not make 3x the rent, there are still ways to afford rent. You may be able to increase your security deposit, find a guarantor, or demonstrate your financial responsibility to the landlord.

A découvrir: Are Sea Walls Covered by Homeowners Insurance? A Complete Guide to Retaining Wall Coverage for Waterfront Properties

How do you calculate 3x the rent?

Calculating the 3x rent is pretty straightforward. You simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month (500 x 3) according to the rule.

How much rent can I afford making 70k?

For an annual salary of $70,000, the monthly rent affordable would be $1,750, according to the 3x rent rule. This means that your monthly income should be at least three times the monthly rent amount.

What are some exceptions to the 3x rent rule?

Some communities use a 2.5x rent rule, meaning a renter’s monthly income should be at least 2.5 times what goes to paying rent. Additionally, some landlords may allow renters to make up for a lower income by increasing their security deposit or finding a guarantor.

Are there ways to afford rent on a lower income?

If you do not make 3 times the rent, you may still be able to get the apartment by increasing the security deposit, finding a guarantor, or demonstrating your financial responsibility. Increasing your security deposit and finding a guarantor can make you a more attractive candidate for a rental property.

What is the 3x rent rule based on?

The 3x rent rule is based on gross income, not net income. It is important to consider your financial situation and responsibilities before committing to a rental amount.

How can I determine how much rent I can afford?

You can use rent calculators to determine how much rent you can afford based on your income. These calculators are available online and can be found on websites such as Zillow and Trulia. This ensures you stay on budget while searching for a rental property.