Unlocking the secret to renting your dream apartment without breaking the bank is as simple as understanding the 3x rent rule. Have you ever wondered how landlords decide if you qualify for that perfect place? Look no further. In this comprehensive guide, we’ll delve into the factors that influence their decisions, provide tips for meeting the 3x rent rule, and explore exceptions to the rule. Get ready to master the art of calculating affordability and learn how to negotiate with the landlord like a pro. Let’s dive in and make renting a breeze!

Key Takeaways

- The 3x rent rule applies to your gross income, not your net income.

- Landlords typically look for monthly gross income equal to 2x to 3x the monthly rent.

- The 3x rent rule is based on the idea that a person’s monthly rent should not exceed three times their gross monthly income.

- If you earn $3,200 per month before taxes, you could spend about $960 per month on rent based on the 30% rent rule.

- If you need to get around the 3x rent rule, you can make a reasonable accommodation request and provide documentation demonstrating your ability to meet the rent amount.

- When filling out a rental application, it’s important to include all sources of income to demonstrate your ability to meet the 3x rent requirement.

The 3x Rent Rule: A Comprehensive Guide for Renters

The 3x rent rule is a common guideline used by landlords to assess a prospective tenant’s ability to afford rent. It dictates that a tenant’s gross monthly income should be at least three times the monthly rent. This rule is based on the assumption that housing costs should not exceed 30% of a person’s income. However, it’s important to note that this rule is not universally applied, and some landlords may have different requirements.

A lire aussi — Dock Coverage: Understanding Homeowners Insurance and Liability Protection

Understanding Gross Income

Gross income refers to your income before taxes and other deductions. This includes wages, salaries, self-employment income, and any other sources of regular income. When applying the 3x rent rule, it’s essential to use your gross income, not your net income. This is because your gross income provides a more accurate picture of your overall earning capacity.

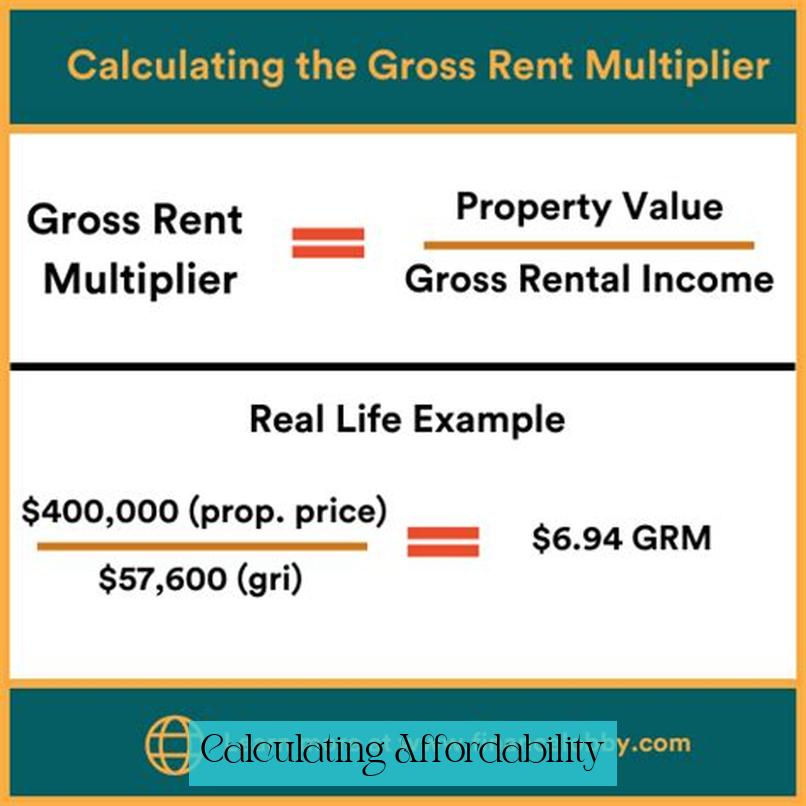

Calculating Affordability

To determine if you meet the 3x rent rule, simply multiply your monthly rent by three. For instance, if your monthly rent is $1,000, you would need to have a gross monthly income of at least $3,000. Keep in mind that this is just a guideline, and some landlords may be willing to consider applicants with slightly lower incomes.

Exceptions to the Rule

There are certain circumstances where you may be able to get around the 3x rent rule. For example, if you have a stable job history and a strong credit score, a landlord may be willing to make an exception. Additionally, if you have a roommate or guarantor, this can also increase your chances of being approved for a rental property.

Factors that Influence Landlord Decisions

Beyond the 3x rent rule, there are other factors that landlords consider when evaluating prospective tenants. These include:

Income Stability

Landlords want to ensure that you have a steady source of income to cover your rent payments. They will typically look at your employment history and income verification documents to assess your financial stability.

Credit History

Your credit history provides insight into your financial responsibility. Landlords will check your credit report to see if you have a history of paying your bills on time and managing debt effectively.

Rental History

If you have a history of being a reliable tenant, this can significantly improve your chances of getting approved for a rental. Landlords will often contact your previous landlords to inquire about your rental behavior.

Tips for Meeting the 3x Rent Rule

If you’re struggling to meet the 3x rent rule, there are a few things you can do to improve your chances of getting approved for a rental:

Increase Your Income

Explore ways to increase your income, such as negotiating a raise at work, getting a part-time job, or starting a side hustle.

Lower Your Expenses

Take a close look at your expenses and identify areas where you can cut back. This could include reducing entertainment spending, dining out less often, or finding cheaper housing.

Negotiate with the Landlord

If you have a strong rental history and a good credit score, you may be able to negotiate with the landlord to accept a lower income-to-rent ratio.

A lire aussi — Dock Insurance Cost: A Complete Guide to Types, Coverage, and Factors Affecting Insurance Costs

Conclusion

The 3x rent rule is a common guideline used by landlords to assess a tenant’s ability to afford rent. While it’s not a hard and fast rule, it’s important to be aware of it when searching for a rental property. By understanding the rule and taking steps to meet the requirements, you can increase your chances of getting approved for your dream home.

1. What is the 3x rent rule?

The 3x rent rule is a guideline used by landlords to assess a prospective tenant’s ability to afford rent. It dictates that a tenant’s gross monthly income should be at least three times the monthly rent.

2. Should I use my gross or net income when applying the 3x rent rule?

You should use your gross income, which refers to your income before taxes and other deductions, when applying the 3x rent rule. This provides a more accurate picture of your overall earning capacity.

3. How do I calculate if I meet the 3x rent rule?

To determine if you meet the 3x rent rule, simply multiply your monthly rent by three. For example, if your monthly rent is $1,000, you would need to have a gross monthly income of at least $3,000.

4. Are there exceptions to the 3x rent rule?

Certain circumstances, such as a stable job history, a strong credit score, having a roommate, or a guarantor, may allow you to get around the 3x rent rule. Landlords may be willing to make exceptions based on these factors.

5. What are the factors that influence landlord decisions beyond the 3x rent rule?

Landlords consider factors such as income stability, employment history, credit score, and the presence of a roommate or guarantor when evaluating prospective tenants.

6. Why is the 3x rent rule based on gross income and not net income?

The 3x rent rule is based on gross income because it provides a more complete picture of a person’s total earning power, including wages, salaries, self-employment income, and other sources of regular income.