“Unlocking the Mystery of 3x Rent Rule: How Much Should Your Income Be to Afford a $1,500 Rent?”

Are you ready to crack the code on the infamous 3x rent rule? Whether you’re a seasoned renter or a newbie in the housing game, understanding this golden ratio is crucial. Imagine the relief of knowing exactly how much you need to earn to comfortably afford that $1,500 monthly rent. Get ready to dive into the nitty-gritty details, uncover some surprising facts, and learn how to ace the 3x rent rule with ease. Let’s make sure your income and rent play nice together!

Key Takeaways

- The 3x rule for rent affordability states that your gross monthly income should be at least 3 times the monthly rent.

- For an apartment with a monthly rent of $1,500, you would need a gross monthly income of at least $4,500 to meet the 3x rule.

- Mortgage lenders and private landlords often require tenants’ annual salaries to be at least three times the monthly rent.

- To calculate the maximum rent you can afford based on your income, multiply your gross monthly income by 0.30.

- The 3x rent rule is based on gross income, not net income, and is used to determine if a tenant is suitable for a rental property.

- Financial planners advise that housing costs, including rent, should not exceed 30% of your before-tax income.

Understanding the 3x Rent Rule: A Comprehensive Guide

The 3x rent rule is a widely accepted guideline used by mortgage lenders and private landlords to determine if a tenant is financially suitable for a rental property. It states that the tenant’s gross monthly income should be at least three times the monthly rent. This rule is designed to ensure that the tenant can comfortably afford the rent and other housing-related expenses without straining their finances.

The 3x rent rule is based on the assumption that housing costs, including rent, should not exceed 30% of a tenant’s before-tax income. This ratio is considered a reasonable balance between housing affordability and financial stability. By adhering to the 3x rent rule, tenants can avoid financial distress and maintain a healthy financial situation.

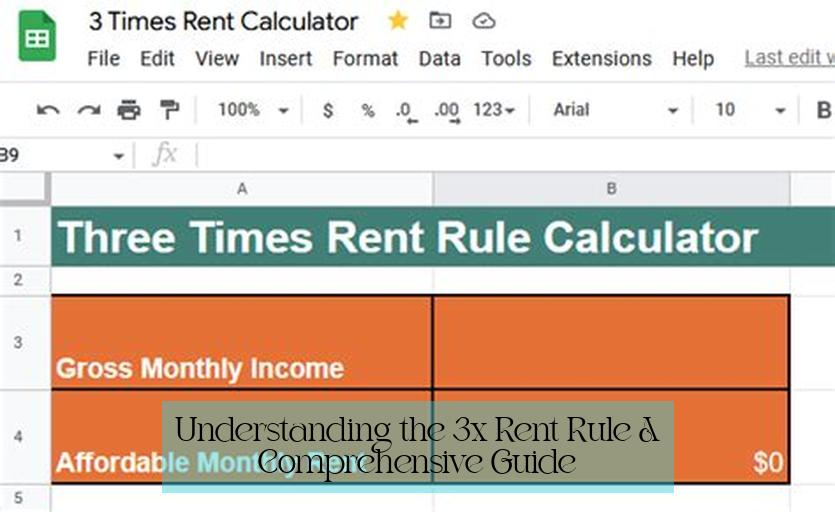

Calculating the Maximum Affordable Rent

To calculate the maximum rent you can afford based on your income, simply multiply your gross monthly income by 0.30. For example, if your gross monthly income is $5,000, the maximum rent you should consider is $1,500 (5,000 x 0.30 = 1,500). This calculation ensures that your housing costs remain within the recommended 30% threshold.

It’s important to note that the 3x rent rule is based on gross income, not net income. Gross income refers to your income before taxes and other deductions, while net income is your income after these deductions. Using gross income provides a more accurate assessment of your financial situation and ensures that you have sufficient income to cover both rent and other living expenses.

Exceptions to the 3x Rent Rule

While the 3x rent rule is a general guideline, there may be exceptions in certain situations. For instance, some tenants may be able to qualify for a rental property with a higher rent-to-income ratio if they have a strong rental history, a stable job, or additional income sources.

Additionally, some landlords may be willing to consider tenants with a lower rent-to-income ratio if they have a personal connection to the tenant, such as being a family member or close friend. However, it’s important to note that these exceptions are not always available and may vary depending on the landlord’s individual criteria.

Implications of the 3x Rent Rule for Tenants

Don’t Miss – The Ultimate Guide to the 2.5 Times Monthly Rent Rule in NYC: Everything You Need to Know

The 3x rent rule has significant implications for tenants. By following this guideline, tenants can:

Read : Mastering Affordability: Calculating 3 Times the Rent of $1,500 and Tips for Saving Money

1. Increase their chances of rental approval: Landlords are more likely to approve tenants who meet the 3x rent rule, as it demonstrates their financial stability and ability to pay rent on time.

2. Avoid financial strain: By ensuring that housing costs do not exceed 30% of their income, tenants can avoid financial strain and maintain a healthy financial situation.

More — Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

3. Improve their credit score: Paying rent on time and in full is essential for building a strong credit score. By adhering to the 3x rent rule, tenants can make timely rent payments and avoid late fees, which can negatively impact their credit score.

Reading List: Unlocking the 3x Rent Rule: Calculating Affordable Rent and Exceptions

4. Qualify for rental assistance programs: Some rental assistance programs have income eligibility requirements based on the 3x rent rule. By meeting this requirement, tenants may qualify for financial assistance to cover a portion of their rent.

Tips for Meeting the 3x Rent Rule

If you’re struggling to meet the 3x rent rule, there are several steps you can take to improve your financial situation and increase your chances of qualifying for a rental property:

1. Increase your income: Consider negotiating a salary increase at work, taking on a part-time job, or starting a side hustle to supplement your income.

2. Reduce your expenses: Take a close look at your monthly expenses and identify areas where you can cut back. This may include reducing unnecessary subscriptions, eating out less often, or negotiating lower bills for utilities or other services.

3. Improve your credit score: A higher credit score can qualify you for lower interest rates on loans and make you a more attractive tenant to landlords. Pay down debt, make on-time payments, and avoid taking on new credit to improve your credit score.

4. Offer a larger security deposit: Some landlords may be willing to consider tenants with a lower rent-to-income ratio if they offer a larger security deposit. This demonstrates your financial commitment and willingness to protect the property.

5. Provide additional documentation: If you have a stable job history or additional income sources, provide these documents to your landlord to demonstrate your financial stability and increase your chances of approval.

Remember, meeting the 3x rent rule is essential for securing a rental property and maintaining financial stability. By following these guidelines and tips, you can increase your chances of finding a suitable rental home that meets your needs and budget.

Q: What is the 3x rent rule?

A: The 3x rent rule is a guideline used by mortgage lenders and landlords to determine if a tenant is financially suitable for a rental property. It states that the tenant’s gross monthly income should be at least three times the monthly rent.

Q: How do you calculate the maximum affordable rent based on the 3x rent rule?

A: To calculate the maximum rent you can afford based on your income, multiply your gross monthly income by 0.30. For example, if your gross monthly income is $5,000, the maximum rent you should consider is $1,500 (5,000 x 0.30 = 1,500).

Q: What income is the 3x rent rule based on?

A: The 3x rent rule is based on gross income, not net income. Gross income refers to income before taxes and other deductions, providing a more accurate assessment of financial situation.

Q: What is the recommended housing cost threshold according to the 3x rent rule?

A: Financial planners advise that housing costs, including rent, should not exceed 30% of before-tax income. This ratio is considered a reasonable balance between housing affordability and financial stability.

Q: What are the exceptions to the 3x rent rule?

A: Some tenants may qualify for a rental property with a higher rent-to-income ratio if they have a strong rental history, a stable job, or additional income sources. Landlords may also consider tenants with a lower rent-to-income ratio in certain situations.

Q: How much gross monthly income is needed to afford a $1,500 rent according to the 3x rent rule?

A: According to the 3x rent rule, if you’re looking at an apartment that costs $1,500 per month in rent, you would need a gross monthly income of at least $4,500 (1,500 x 3) to be considered a suitable tenant.