Is 2.5 times the monthly rent really the magic number when it comes to renting your next apartment? Whether you’re a seasoned renter or a newbie in the housing market, understanding the ins and outs of the 2.5x rent rule can make all the difference. In this article, we’ll delve into the age-old debate of whether it’s based on gross or net income, explore alternative measures of rent affordability, and unravel the rationale behind this widely used standard. So, buckle up and get ready to decode the mystery of 2.5 times the monthly rent – it’s about to become crystal clear!

Key Takeaways

- The 2.5x rent rule means that a tenant’s annual income should be at least 2.5 times the annual cost of the rent.

- When determining affordable rent, the 2.5x rent rule is a common standard in the rental industry to ensure tenants are not overburdened by housing costs.

- For rent affordability, the 30% rent rule suggests spending around 30% of gross income on rent, but it’s not one-size-fits-all advice.

- Places usually require tenants to make 2 or even 3 times the amount of rent to get approved, based on their gross income.

- Landlords often use the 2.5x rent multiplier to determine the minimum income required for tenants, and it’s typically based on gross income.

- The total household net income should be 2.5x the monthly rent of the unit, as per the 2.5x rent rule for tenant eligibility.

2.5 Times the Monthly Rent: Gross or Net? Understanding the Standard

The 2.5 times the monthly rent rule is a widely used benchmark in the rental industry to assess a tenant’s financial capability and ensure they can comfortably afford the rent. This rule suggests that a tenant’s annual income should be at least 2.5 times the annual cost of the rent. For instance, if the monthly rent is $1,000, the tenant’s annual income should be at least $30,000 (12 x $1,000 x 2.5).

Landlords often rely on the 2.5x rent multiplier to determine the minimum income requirement for tenants. This multiplier is typically based on the tenant’s gross income, which refers to their income before taxes and other deductions. By using gross income, landlords can get a clearer picture of the tenant’s overall financial situation and earning capacity.

However, some tenants may argue that using gross income overstates their financial capacity, as it does not account for essential expenses and deductions that reduce their disposable income. To address this concern, some landlords may consider using net income, which is the income remaining after taxes and other deductions. However, it’s important to note that using net income may not be as common in the rental industry as using gross income.

The Rationale Behind the 2.5x Rent Rule

The 2.5x rent rule is not just an arbitrary number; it’s based on the principle of financial prudence and affordability. Rent is typically one of the largest monthly expenses for tenants, and it’s crucial to ensure that they have sufficient income to cover this expense without straining their finances.

The 2.5x rule provides a reasonable buffer to ensure that tenants have enough money left over for other essential expenses, such as food, transportation, healthcare, and savings. By requiring tenants to have an income that is 2.5 times the rent, landlords can minimize the risk of tenants falling behind on rent payments or facing financial difficulties.

Moreover, the 2.5x rent rule helps to protect landlords from potential financial losses. If a tenant cannot afford the rent, they may be more likely to break their lease or default on their payments. This can result in lost rental income, legal fees, and other expenses for the landlord. By using the 2.5x rent rule, landlords can reduce the risk of these financial losses and ensure a more stable rental income stream.

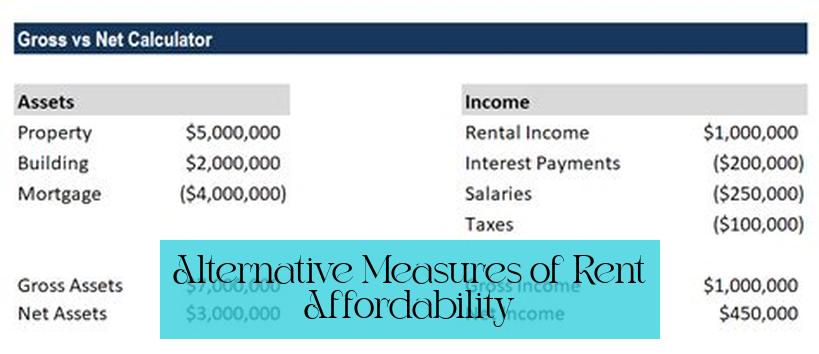

Alternative Measures of Rent Affordability

While the 2.5x rent rule is a widely used standard, it’s not the only measure of rent affordability. Some other common metrics include:

-

30% Rent Rule: This rule suggests that tenants should spend no more than 30% of their gross income on rent. This rule is often used in conjunction with the 2.5x rent rule to provide a more comprehensive assessment of affordability.

-

50/30/20 Rule: This budgeting rule suggests that individuals should allocate 50% of their income to essential expenses (including rent), 30% to discretionary expenses, and 20% to savings and debt repayment. This rule can help tenants prioritize their expenses and ensure they have sufficient funds for all their financial obligations.

Also read Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

-

Debt-to-Income Ratio: This ratio measures the amount of a tenant’s monthly income that is used to pay off debt obligations. Lenders typically prefer tenants with a debt-to-income ratio below 36%, as this indicates a manageable debt load.

It’s important to note that these alternative measures of rent affordability may be more or less stringent than the 2.5x rent rule, depending on the specific circumstances. Landlords and tenants should consider these different metrics and determine which one is most appropriate for their situation.

Conclusion

Read : Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

The 2.5 times the monthly rent rule is a valuable tool for landlords and tenants to assess rent affordability and ensure financial stability. By using this rule, landlords can minimize the risk of financial losses and tenants can avoid overextending themselves financially. However, it’s important to consider alternative measures of rent affordability and tailor the approach to the specific circumstances of each landlord and tenant.

What does the 2.5 times the monthly rent rule mean?

The 2.5 times the monthly rent rule suggests that a tenant’s annual income should be at least 2.5 times the annual cost of the rent. This standard is commonly used in the rental industry to ensure tenants can afford their housing costs without being overburdened.

Should rent be based on gross or net income?

The 2.5 times the monthly rent rule is typically based on gross income, which is the income before taxes and deductions. This allows landlords to assess the tenant’s overall financial situation and earning capacity. While some tenants may argue that using gross income overstates their financial capacity, using net income, which is the income remaining after taxes and deductions, may not be as common in the rental industry.

What is the rationale behind the 2.5 times the monthly rent rule?

The 2.5 times the monthly rent rule is based on the principle of financial prudence and affordability. It ensures that tenants have enough income to cover their rent without straining their finances, leaving them with money for other essential expenses and savings.

How is the 2.5 times the monthly rent rule used by landlords?

Landlords often rely on the 2.5 times the monthly rent rule to determine the minimum income requirement for tenants. By using this multiplier, they can minimize the risk of tenants falling behind on rent payments or facing financial difficulties.

Is the 2.5 times the monthly rent rule a one-size-fits-all guideline?

The 2.5 times the monthly rent rule is a common standard in the rental industry, but it’s important to note that different places may have variations in their income requirements for tenants. While the 2.5 times multiplier is widely used, it’s not a one-size-fits-all guideline and may vary based on location and specific landlord policies.

How does the 2.5 times the monthly rent rule contribute to rent affordability?

The 2.5 times the monthly rent rule provides a reasonable buffer to ensure that tenants have enough money left over for other essential expenses, such as food, transportation, healthcare, and savings. It helps minimize the risk of tenants being overburdened by housing costs and promotes overall financial stability.