Are you ready to solve the age-old mystery of ‘How much rent can I afford?’ Well, get ready to unravel the secrets of the 3x Rent Rule! Imagine a world where your monthly rent is not just a number, but a carefully calculated piece of your financial puzzle. Join us as we dive into the fascinating world of rent affordability and learn how to determine if that $1,500 dream apartment is within your financial grasp. Let’s crunch some numbers and uncover the magic behind the 3x Rent Rule!

Key Takeaways

- The 3x rule for rent affordability states that your gross monthly income should be at least 3 times the monthly rent.

- For an apartment with a monthly rent of $1,500, you would need a gross monthly income of at least $4,500 to be considered a suitable tenant.

- Mortgage lenders and private landlords often require tenants’ annual salaries to be at least three times the monthly rent.

- The 3x rent rule is based on gross income, not net income, and is used to determine the maximum affordable rent.

- Financial planners advise that housing costs, including rent, should not exceed 30% of your before-tax income.

- Calculating 3 times the rent involves multiplying the monthly rent by 3 to determine the income required to keep housing payments less than 1/3 of income.

The 3x Rent Rule: Determining Affordability

The 3x rent rule is a widely accepted guideline used by mortgage lenders and private landlords to determine whether a potential tenant can afford to rent a particular property. The rule states that a tenant’s gross monthly income should be at least three times the monthly rent. For example, if the monthly rent of an apartment is $1,500, the tenant would need a gross monthly income of at least $4,500 to be considered a suitable tenant.

Trending — Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

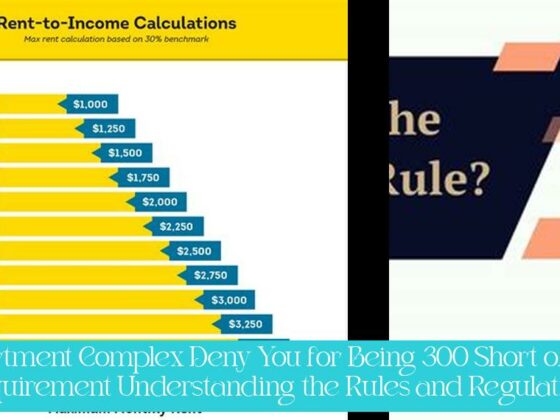

This rule is based on the assumption that housing costs, including rent, should not exceed 30% of a person’s before-tax income. This ratio is considered sustainable because it allows tenants to cover their housing expenses while still having enough money left over for other expenses, such as food, transportation, and healthcare.

More — Unlocking Success: Mastering the 2.5 Times Monthly Rent Rule for Landlords and Tenants

Exceptions to the 3x Rent Rule

While the 3x rent rule is a general guideline, there are some exceptions to the rule. For example, some landlords may be willing to rent to tenants who have a lower income if they have a good credit history and a stable job. Additionally, some tenants may be able to afford to pay more than 3x the rent if they have no other major expenses, such as student loans or car payments.

Ultimately, the decision of whether or not to rent to a tenant who does not meet the 3x rent rule is up to the landlord. Landlords should consider the tenant’s overall financial situation, including their income, expenses, and credit history, when making this decision.

Calculating 3 Times the Rent

Calculating 3 times the rent is a simple process. Simply multiply the monthly rent by 3. For example, if the monthly rent is $1,500, 3 times the rent would be $4,500.

It is important to note that the 3x rent rule is based on gross income, not net income. Gross income is the amount of money you earn before taxes and other deductions are taken out. Net income is the amount of money you have left after taxes and other deductions have been taken out.

How Much Rent Can You Afford?

If you are looking to rent an apartment, it is important to determine how much rent you can afford. The 3x rent rule is a good starting point, but it is not the only factor to consider. You should also consider your other expenses, such as food, transportation, and healthcare.

Discover – Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

A good rule of thumb is to spend no more than 30% of your before-tax income on housing costs. This includes rent, utilities, and other housing-related expenses. If you are spending more than 30% of your income on housing, you may be at risk of financial hardship.

Tips for Saving Money on Rent

If you are struggling to afford rent, there are a few things you can do to save money.

Also read Mastering the 2.5 Times Monthly Rent Rule: A Renter’s Essential Guide

- Look for a roommate: Sharing an apartment with a roommate can help you save money on rent. You can split the cost of rent, utilities, and other expenses.

- Negotiate with your landlord: If you are a good tenant, you may be able to negotiate a lower rent with your landlord. Be prepared to provide documentation of your income and expenses.

- Get a part-time job: If you need to supplement your income, getting a part-time job can help you cover your rent and other expenses.

- Apply for government assistance: There are a number of government programs that can help low-income tenants afford rent. Contact your local housing authority to learn more about these programs.

Conclusion

The 3x rent rule is a useful guideline for determining whether or not you can afford to rent a particular apartment. However, it is important to consider your other expenses and your overall financial situation when making this decision. If you are struggling to afford rent, there are a number of things you can do to save money.

1. What is the 3x rent rule?

The 3x rent rule is a guideline used by mortgage lenders and landlords to determine whether a potential tenant can afford to rent a property. It states that a tenant’s gross monthly income should be at least three times the monthly rent.

2. How is the 3x rent rule calculated?

To calculate 3 times the rent, simply multiply the monthly rent by 3. For example, if the monthly rent is $1,500, 3 times the rent would be $4,500.

3. What is the purpose of the 3x rent rule?

The 3x rent rule is used to ensure that housing costs, including rent, do not exceed 30% of a person’s before-tax income, allowing them to cover their housing expenses while still having enough money left over for other expenses.

4. Are there exceptions to the 3x rent rule?

While the 3x rent rule is a general guideline, there are exceptions. Some landlords may consider tenants with lower income if they have a good credit history and a stable job. Ultimately, the decision is up to the landlord, who should consider the tenant’s overall financial situation.

5. How much income is needed to afford a $1,500 rent according to the 3x rule?

According to the 3x rule, if the monthly rent is $1,500, a gross monthly income of at least $4,500 is needed to be considered a suitable tenant.

6. Is the 3x rent rule based on gross or net income?

The 3x rent rule is based on gross income, which is the amount of money earned before taxes and other deductions are taken out. It is not based on net income, which is the amount of money left after taxes and deductions.