Unlocking the door to your dream apartment can be an exciting journey, but it often comes with a financial hurdle to clear: the 2.5 times monthly rent requirement. As renters, we’ve all been there, crunching the numbers and wondering if our bank accounts will measure up. In this comprehensive guide, we’ll delve into the nitty-gritty of why landlords use this rule, whether it’s fair, and most importantly, how to make sure you meet the mark. So, grab a cup of coffee and get ready to navigate the world of renting with a dash of humor and a whole lot of practical advice.

Key Takeaways

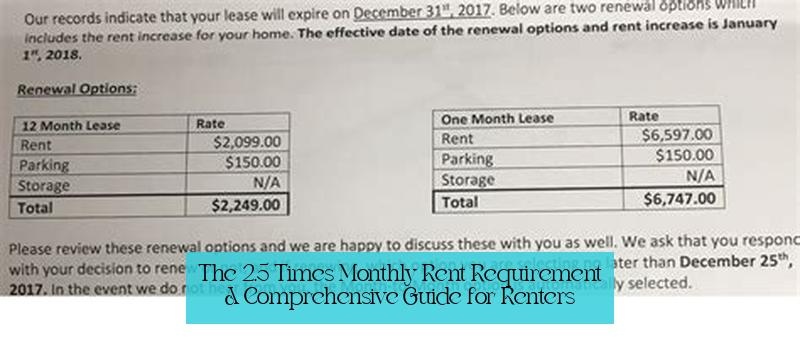

- The recommended income for renting is at least 2.5 times the monthly rent amount.

- For example, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month in gross income.

- Some communities use a 3 times rent calculator formula, while others recommend 2.5 times the monthly rent amount.

- It is possible to make a reasonable accommodation request to be exempt from the 3 times rent policy by providing documentation demonstrating the ability to meet the rent amount.

- There are discussions and concerns about the challenges of meeting the 2.5 times rent requirement, especially in high-cost areas like Manhattan.

- There are questions and discussions about the feasibility of renting when income does not meet the 2.5 times rent requirement.

The 2.5 Times Monthly Rent Requirement: A Comprehensive Guide for Renters

>> Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

Renting an apartment or house is a significant financial commitment, and landlords typically have specific criteria that prospective tenants must meet. One of the most common requirements is that a renter’s monthly income should be at least 2.5 times the monthly rent amount. This means that if the rent is \$1,000 per month, the tenant should be earning at least \$2,500 per month in gross income.

Why Do Landlords Use the 2.5 Times Rent Rule?

Landlords use the 2.5 times rent rule to assess a tenant’s ability to afford the rent and minimize the risk of late or missed payments. By requiring a higher income, landlords can increase the likelihood that the tenant will have sufficient funds to cover the rent and other expenses. Additionally, this rule helps landlords avoid the potential costs associated with evicting a tenant who cannot pay the rent.

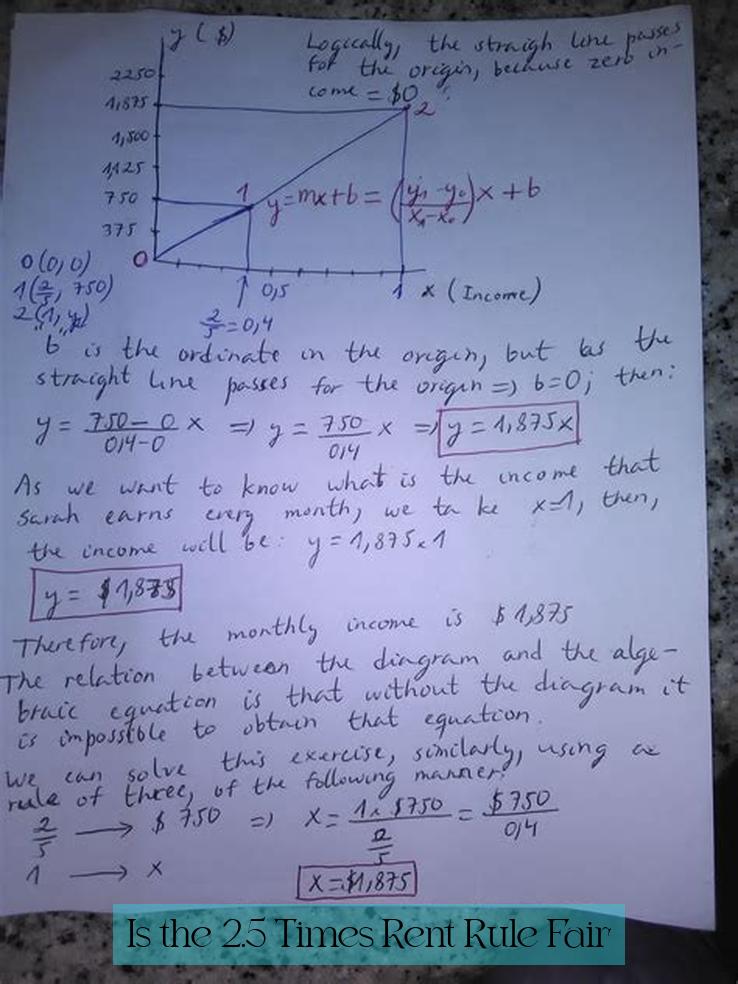

Is the 2.5 Times Rent Rule Fair?

The 2.5 times rent rule has been a subject of debate, with some arguing that it is unfair to tenants, especially in high-cost areas where rents are significantly higher than in other parts of the country. Critics of the rule argue that it excludes many qualified tenants who may have a stable income but do not meet the 2.5 times rent requirement.

More related > Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

Despite these concerns, many landlords continue to use the 2.5 times rent rule as a screening tool. However, some landlords may be willing to make exceptions for tenants who have a strong rental history, a co-signer, or other factors that demonstrate their ability to pay the rent on time.

How to Meet the 2.5 Times Rent Requirement

If you are struggling to meet the 2.5 times rent requirement, there are a few things you can do to improve your chances of qualifying for an apartment or house:

- Increase your income: This could involve asking for a raise at your current job, getting a part-time job, or starting a side hustle.

- Get a co-signer: A co-signer is someone who agrees to be legally responsible for the rent if you are unable to pay. Having a co-signer can help you qualify for an apartment even if you do not meet the 2.5 times rent requirement on your own.

- Offer a larger security deposit: Some landlords may be willing to accept a larger security deposit in lieu of a higher income. A larger security deposit can give the landlord more confidence that you will be able to pay the rent on time.

- Negotiate with the landlord: If you have a good rental history or other factors that demonstrate your ability to pay the rent, you may be able to negotiate with the landlord to accept a lower income.

Conclusion

The 2.5 times rent rule is a common requirement used by landlords to assess a tenant’s ability to afford the rent. While this rule can be challenging for some tenants to meet, especially in high-cost areas, there are steps that tenants can take to improve their chances of qualifying for an apartment or house. By understanding the rule and exploring options to meet the requirement, tenants can increase their chances of securing a rental property that meets their needs.

1. Why do landlords use the 2.5 times rent rule?

Landlords use the 2.5 times rent rule to assess a tenant’s ability to afford the rent and minimize the risk of late or missed payments. This requirement helps ensure that tenants have sufficient funds to cover the rent and other expenses, reducing the likelihood of eviction.

2. Is the 2.5 times rent rule fair?

The 2.5 times rent rule has been a subject of debate, with some arguing that it is unfair to tenants, especially in high-cost areas. Critics argue that it excludes many qualified tenants who may have a stable income but do not meet the 2.5 times rent requirement. However, some landlords may be willing to make exceptions for tenants with a strong rental history, a co-signer, or other factors demonstrating their ability to pay rent on time.

3. How can I meet the 2.5 times rent requirement?

If you are struggling to meet the 2.5 times rent requirement, you can consider increasing your income by asking for a raise, getting a part-time job, or starting a side hustle. Another option is to get a co-signer, someone who agrees to pay the rent if you are unable to do so.

4. Is 2.5 times rent enough?

The 2.5 times rent requirement is a common guideline used by landlords to assess a tenant’s ability to afford the rent. However, there are discussions and concerns about the challenges of meeting this requirement, especially in high-cost areas. While it is a widely used screening tool, some landlords may be open to making exceptions based on other factors demonstrating the tenant’s ability to pay rent on time.

5. What does it mean by 2.5 times the rent?

According to the 2.5 times rent rule, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month in gross income. This guideline helps landlords ensure that tenants have sufficient income to cover the rent and other expenses.

6. Why do landlords want you to make 3 times the rent?

Landlords may use a 3 times rent calculator formula, especially in larger cities, to ensure that tenants have a higher income relative to the rent. This requirement is aimed at reducing the risk of late or missed payments and ensuring that tenants can afford the rent and other living expenses.