Are you a landlord or tenant trying to navigate the ins and outs of rental requirements? Look no further! In this comprehensive guide, we will delve into the intriguing world of the 2.5 times the monthly rent rule. Whether you’re a renter aiming to meet the income threshold or a landlord seeking to ensure financial stability, understanding the significance of this rule is key. So, buckle up and get ready to unravel the mysteries behind the 2.5 times the monthly rent rule!

Key Takeaways

- The 2.5 times the monthly rent rule means that a tenant’s gross income should be at least 2.5 times the monthly rent to qualify as a stable tenant.

- For example, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month in gross income to meet the 2.5 times rent requirement.

- Landlords often use the 2.5 times rent rule to ensure that tenants have sufficient income to afford the rent and other living expenses.

- Some communities may use a 3 times rent calculator formula, requiring a renter’s monthly income to be at least 3 times the rent amount.

- The 2.5 times rent rule is a common requirement in many areas and is intended to protect landlords by ensuring that tenants can afford the rent.

- Calculating 2.5 times the rent is important for landlords and property managers to assess a tenant’s financial stability and ability to meet rental obligations.

2.5 Times the Monthly Rent: A Comprehensive Guide for Landlords and Tenants

The 2.5 times the monthly rent rule is a common requirement in many areas and is used by landlords to ensure that tenants can afford the rent and other living expenses. This rule states that a tenant’s gross monthly income should be at least 2.5 times the monthly rent. For example, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month. This rule helps to protect landlords by ensuring that tenants have sufficient income to meet their rental obligations.

Why Landlords Use the 2.5 Times Rent Rule

There are several reasons why landlords use the 2.5 times rent rule. First, it helps to ensure that tenants can afford the rent. This is important because if a tenant cannot afford the rent, they may be more likely to fall behind on payments or even default on their lease. Second, the 2.5 times rent rule helps to protect landlords from financial losses. If a tenant defaults on their lease, the landlord may be responsible for the unpaid rent, as well as other costs such as legal fees and repairs. Third, the 2.5 times rent rule can help landlords to attract and retain quality tenants. Tenants who can afford the rent are more likely to be responsible and respectful of the property.

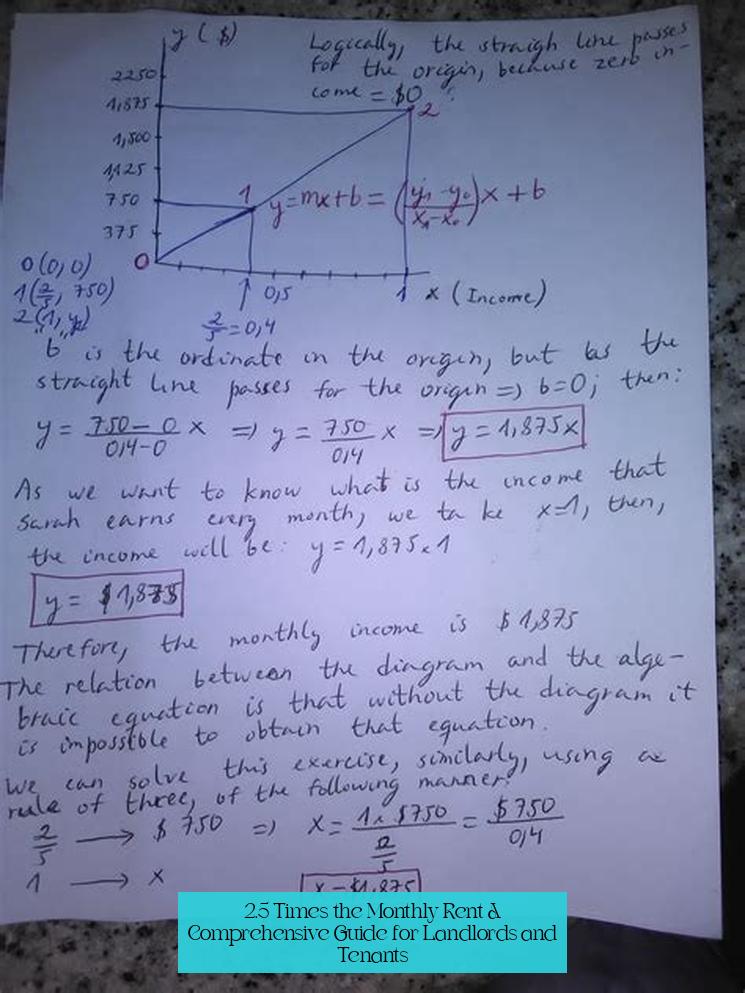

How to Calculate 2.5 Times the Rent

Calculating 2.5 times the rent is simple. Simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, 2.5 times the rent would be $2,500. This means that a tenant would need to earn at least $2,500 per month to qualify for the apartment.

Exceptions to the 2.5 Times Rent Rule

There are some exceptions to the 2.5 times rent rule. For example, some landlords may be willing to rent to tenants who earn less than 2.5 times the rent if they have a good credit history or if they can provide a co-signer. Additionally, some communities may have laws that prohibit landlords from using the 2.5 times rent rule.

The Importance of a Stable Income

When it comes to renting an apartment, one of the most important factors that landlords consider is your income. This is because they want to make sure that you can afford the rent and that you are a stable tenant. A stable income is one that is reliable and consistent. It is not subject to large fluctuations or seasonal changes. There are a few things that you can do to improve your chances of getting approved for an apartment, even if you do not have a stable income. One is to provide proof of other sources of income, such as child support or alimony. Another is to get a co-signer who has a stable income.

How to Prove Your Income

When you apply for an apartment, you will typically be asked to provide proof of your income. This can be done in a number of ways, such as:

- Providing pay stubs

- Providing bank statements

- Providing a letter from your employer

What to Do if You Don’t Have a Stable Income

If you do not have a stable income, there are a few things that you can do to improve your chances of getting approved for an apartment. One is to provide proof of other sources of income, such as child support or alimony. Another is to get a co-signer who has a stable income.

Additional Tips for Renters

In addition to providing proof of income, there are a few other things that you can do to improve your chances of getting approved for an apartment. These include:

- Having a good credit score

- Having a good rental history

- Being able to provide references

By following these tips, you can increase your chances of getting approved for an apartment, even if you do not have a stable income.

1. Why do landlords use the 2.5 times rent rule?

Landlords use the 2.5 times rent rule to ensure that tenants can afford the rent, protect themselves from financial losses, and attract responsible tenants who are more likely to fulfill their rental obligations.

2. How is 2.5 times the rent calculated?

To calculate 2.5 times the rent, simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, 2.5 times the rent would be $2,500.

3. Are there exceptions to the 2.5 times rent rule?

Yes, some landlords may consider tenants who earn less than 2.5 times the rent if they have a good credit history or can provide a co-signer. Additionally, some communities may have laws that prohibit landlords from using the 2.5 times rent rule.

4. What does it mean to have a rent-to-income ratio of 2.5 times the monthly rent?

A rent-to-income ratio of 2.5 times the monthly rent means that a tenant’s gross monthly income should be at least 2.5 times the monthly rent to qualify as a stable tenant. For example, if the monthly rent is $1,000, the tenant should be earning at least $2,500 per month.

5. Is 2.5 times the rent enough for all landlords?

While 2.5 times the rent is a common requirement, some landlords or communities may use different criteria, such as a 3 times rent calculator formula. It’s important for tenants and landlords to be aware of the specific requirements in their area.

6. How does the 2.5 times rent rule benefit landlords and tenants?

The 2.5 times rent rule benefits landlords by ensuring that tenants have sufficient income to afford the rent and other living expenses, while also benefiting tenants by promoting financial stability and responsible tenancy.