Unlocking the mystery of calculating three times the rent is like finding the key to a treasure chest. It’s a crucial step in the renting process, and yet it can be as elusive as a pot of gold at the end of a rainbow. But fear not, as we embark on this journey together, we’ll unravel the secrets behind this rule and equip you with the knowledge to navigate the rental landscape with confidence. So, fasten your seatbelt and get ready to decode the formula, understand the rationale, and explore the exceptions to the 3x Rent Rule. Let’s dive in and demystify the world of rent affordability!

Key Takeaways

- To calculate 3 times the rent, simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month (500 x 3).

- Private landlords often require tenants’ annual salaries to be at least three times the monthly rent.

- The 3x rent rule is based on your gross income, not your net income. Your gross monthly income should be 3 times the monthly rent.

- If the rent is $1,400 per month, three times the rent would be $4,200 per month.

- When determining affordable rent, multiply the monthly rent by 3 to calculate the required income per tenant, then divide by the number of tenants.

- Apartment communities typically look for an annual income that is 40 times your monthly rent to determine the maximum rent you can afford.

Calculating Three Times the Rent: A Comprehensive Guide

Article populaire > Mastering the 3x Rent Income Calculator: A Complete Guide for Affordability

Three times the rent is a common requirement for both private landlords and mortgage lenders. Understanding how to calculate this amount is crucial when searching for an apartment or applying for a mortgage. In this guide, we’ll delve into the formula, provide examples, and explore the rationale behind this requirement.

Formula for Calculating Three Times the Rent

To calculate three times the rent, simply multiply the monthly rent by 3. For instance, if your monthly rent is $1,400, three times the rent would be $4,200. This means that you should earn at least $4,200 per month to qualify for the apartment.

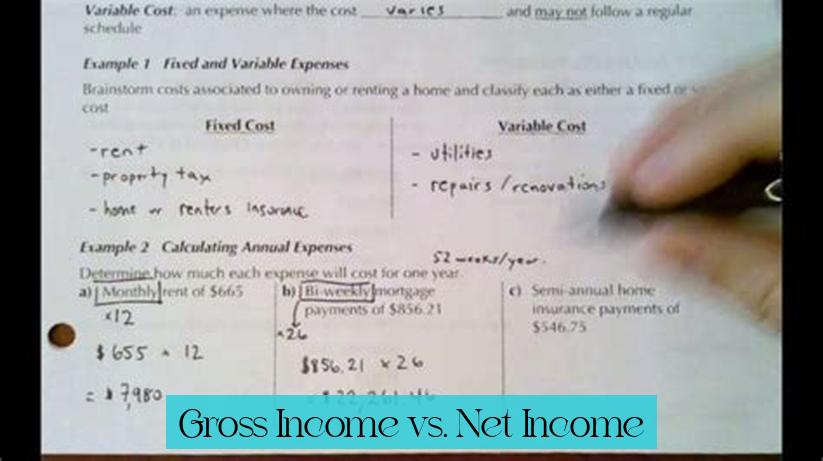

Gross Income vs. Net Income

It’s important to note that the 3x rent rule is based on your gross income, not your net income. Gross income refers to your total income before taxes and other deductions, while net income is what you receive after these deductions. Therefore, ensure you consider your gross income when calculating three times the rent.

Rationale Behind the 3x Rent Rule

The 3x rent rule is designed to ensure that tenants have sufficient income to cover their rent and other expenses comfortably. Landlords and lenders want to minimize the risk of tenants defaulting on their rent payments or struggling to make ends meet. By requiring tenants to earn at least three times the rent, they can increase their confidence in the tenant’s ability to pay the rent consistently.

Example Calculations

Let’s look at a few examples to solidify your understanding:

- Example 1: If your monthly rent is $1,200, three times the rent would be $3,600. This means you should earn at least $3,600 per month to qualify.

- Example 2: If your gross monthly income is $5,000, you can afford to pay up to $1,666.67 in rent per month (5,000 x 0.33 = 1,666.67).

- Example 3: If you’re paid biweekly and your monthly rent is $1,500, three times the rent would be $4,500. This means you should earn at least $2,250 per paycheck (4,500 / 2 = 2,250).

Affordability and Income Guidelines

While the 3x rent rule is a common guideline, it’s essential to consider your own financial situation and budget. Some factors to keep in mind include:

À lire absolument – 3x Rent Rule: Understanding Gross vs. Net Income and How to Meet Landlords’ Requirements

Debt-to-Income Ratio

Your debt-to-income ratio compares your monthly debt payments to your gross income. Ideally, your debt-to-income ratio should be below 36%. If it’s higher, you may have difficulty qualifying for a loan or meeting your rent obligations.

Emergency Savings

Having an emergency fund is crucial for unexpected expenses. Aim to save at least three to six months’ worth of living expenses, including rent, to protect yourself from financial emergencies.

Other Expenses

Consider your other monthly expenses, such as utilities, groceries, transportation, and entertainment. Make sure you have sufficient income left over after paying your rent to cover these expenses comfortably.

Exceptions to the 3x Rent Rule

Pour les curieux, State Farm Dock Insurance: Comprehensive Coverage for Your Waterfront Property

In some cases, you may be able to qualify for an apartment or mortgage even if you don’t earn three times the rent. Here are a few exceptions:

Good Credit History

A strong credit history demonstrates your ability to manage debt responsibly. Landlords and lenders may be willing to overlook a slightly lower income if you have a high credit score.

Co-signers

If you have a co-signer with a strong income and credit history, they can help you qualify for a loan or apartment even if you don’t meet the 3x rent requirement.

Rental Assistance Programs

Government and non-profit organizations offer rental assistance programs that can help low-income individuals and families afford housing. These programs may provide financial assistance or help secure affordable housing options.

Conclusion

Understanding how to calculate three times the rent is essential for apartment hunting and mortgage applications. Remember to consider your gross income, debt-to-income ratio, emergency savings, and other expenses when determining affordability. While the 3x rent rule is a common guideline, exceptions may apply based on your individual circumstances. By carefully considering these factors and exploring available options, you can increase your chances of securing housing that meets your needs and fits your budget.

1. How do I calculate 3 times the rent?

To calculate 3 times the rent, simply multiply the monthly rent by 3. For example, if the rent is $500 per month, you would need to earn at least $1,500 per month (500 x 3) according to the rule.

2. How much to afford $1,500 rent?

According to the rule, you can multiply your gross monthly income by 0.30 to determine the maximum rent you can afford. For example, if your gross income is $5,000 a month, your rent should be a maximum of $1,500 (5,000 x 0.30 = 1,500).

3. Do you really need to make 3 times the rent?

Mortgage lenders have adopted it as a qualification ratio when approving you for a loan. The 3x rent rule is designed to ensure that tenants have sufficient income to cover their rent and other expenses comfortably. Landlords and lenders want to minimize the risk of tenants defaulting on their rent payments or struggling to make ends meet. By requiring tenants to earn at least three times the rent, they can increase their confidence in the tenant’s ability to pay the rent consistently.