Unlocking the secret to finding the perfect tenant- it’s all about the 2.5 Times Rent Rule! Whether you’re a landlord looking for the ideal candidate or a tenant eager to ace the affordability test, understanding the 2x and 3x Rent Rules is crucial. In this comprehensive guide, we’ll delve into the nitty-gritty of these rules, debunking myths, and providing practical tips for both parties. So, buckle up and get ready to master the art of rental affordability like a pro!

Key Takeaways

- The 2.5x rent rule means that a tenant should be earning at least 2.5 times the monthly rent in gross income to afford the rent.

- When determining affordability, landlords typically use the 2.5x rent multiplier, meaning the tenant’s income should be 2.5 times the monthly rent.

- Landlords usually require tenants to have monthly gross income equal to between 2x and 3x the monthly rent, before taxes and other deductions.

- The 2x or 3x rent requirement is based on gross income, not net income, when evaluating a tenant’s affordability.

- The 3x rent rule is based on gross income, not net income, indicating that the gross monthly income should be 3 times the monthly rent.

- For a tenant to afford the rent, their income should be at least 2.5 times the monthly rent, based on the 2.5x rent rule.

The 2.5 Times Rent Rule: A Comprehensive Guide for Landlords and Tenants

The 2.5 times rent rule is a common guideline used by landlords and property managers to determine whether a prospective tenant can afford the rent. This rule states that a tenant’s gross income should be at least 2.5 times the monthly rent. For example, if the monthly rent is $1,000, the tenant’s gross income should be at least $2,500. This rule is based on the assumption that housing costs should not exceed 30% of a household’s gross income.

There are several reasons why landlords use the 2.5 times rent rule. First, it helps them to ensure that tenants have the financial means to pay the rent on time and in full each month. Second, it helps to reduce the risk of tenants defaulting on their lease or causing damage to the property. Third, it helps to protect landlords from financial losses in the event that a tenant breaks their lease or moves out early.

How to Calculate 2.5 Times Rent

Reading List: Mastering the 2.5 Times Rent Calculator: Your Ultimate Guide to Affordability

To calculate 2.5 times rent, simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, 2.5 times rent would be $2,500.

For you, Unlocking the 2.5 Times Monthly Rent Rule: A Renter’s Comprehensive Guide

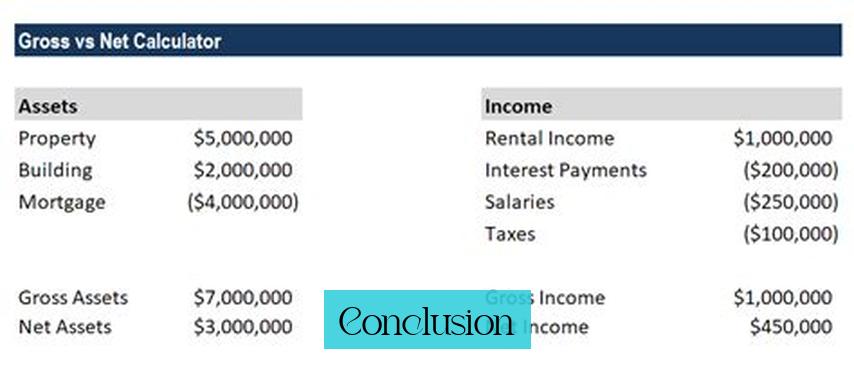

What is Gross Income?

Gross income is the total amount of money that a person earns before taxes and other deductions. This includes wages, salaries, tips, commissions, bonuses, and self-employment income.

Exceptions to the 2.5 Times Rent Rule

There are some exceptions to the 2.5 times rent rule. For example, some landlords may be willing to rent to tenants who have a lower income if they have a good rental history or if they can provide a co-signer. Additionally, some landlords may be willing to negotiate the rent with tenants who are willing to sign a longer lease.

2x and 3x Rent Rules

In addition to the 2.5 times rent rule, there are also 2x and 3x rent rules. The 2x rent rule states that a tenant’s gross income should be at least 2 times the monthly rent. The 3x rent rule states that a tenant’s gross income should be at least 3 times the monthly rent. These rules are less common than the 2.5 times rent rule, but they are sometimes used by landlords who are looking for tenants with a higher income.

Which Rent Rule Should You Use?

The best rent rule to use will depend on the specific circumstances of the landlord and the tenant. Landlords who are looking for tenants with a higher income may want to use the 3x rent rule. Landlords who are willing to rent to tenants with a lower income may want to use the 2x rent rule.

Tips for Tenants

If you are a tenant who is struggling to find an apartment that you can afford, there are a few things that you can do. First, try looking for apartments in less expensive neighborhoods. Second, try negotiating with landlords who are willing to rent to tenants with a lower income. Third, consider getting a roommate to help you share the cost of rent.

Conclusion

The 2.5 times rent rule is a common guideline used by landlords and property managers to determine whether a prospective tenant can afford the rent. This rule is based on the assumption that housing costs should not exceed 30% of a household’s gross income. There are some exceptions to the 2.5 times rent rule, and the best rent rule to use will depend on the specific circumstances of the landlord and the tenant.

Read : Mastering the 2.5 Times Monthly Rent Rule: Your Guide to Meeting and Exceeding It

1. What is the 2.5 times rent rule and why is it used by landlords and property managers?

The 2.5 times rent rule states that a tenant’s gross income should be at least 2.5 times the monthly rent. Landlords and property managers use this rule to ensure that tenants have the financial means to pay rent on time, reduce the risk of defaulting, and protect themselves from financial losses.

2. How do you calculate 2.5 times rent?

To calculate 2.5 times rent, simply multiply the monthly rent by 2.5. For example, if the monthly rent is $1,000, 2.5 times rent would be $2,500.

3. What is gross income and why is it important in the 2.5 times rent rule?

Gross income is the total amount of money a person earns before taxes and other deductions. It includes wages, salaries, tips, commissions, bonuses, and self-employment income. Gross income is important in the 2.5 times rent rule as it helps determine a tenant’s affordability.

4. Are there exceptions to the 2.5 times rent rule?

Yes, some landlords may be willing to rent to tenants with lower income if they have a good rental history or can provide a co-signer. Additionally, landlords may be open to negotiating rent with tenants willing to sign a longer lease.

5. What are the 2x and 3x rent rules, and how do they compare to the 2.5 times rent rule?

The 2x rent rule states that a tenant’s gross income should be at least 2 times the monthly rent, while the 3x rent rule requires 3 times the monthly rent. These rules provide alternative benchmarks for evaluating tenant affordability compared to the 2.5 times rent rule.

6. Should rent be based on gross or net income?

Rent is typically based on gross income, not net income, when using the 2.5 times rent rule or similar guidelines. Gross income provides a clearer picture of a tenant’s overall earning capacity before deductions.